The Orange County Property Appraiser is an elected constitutional officer listed in the Orange County charter as the County Executive Director serving the people of Orange County. An Orange County Property Appraiser plays a vital role in the region’s real estate market. Orange County Property Appraiser, Amy Mercado won in November 2020.

There is an excellent time to hire an Orange County Property appraiser and a lousy time to avoid it. When you need a professional real estate appraisal service, the most important thing is to prepare in advance to optimize your investment. You must know what you’re looking for when looking for an Orange County Property appraiser.

Or

You can find an Orange County Property appraiser through several sources. These sources include your GP, real estate agents, and the internet. The internet can be helpful, but you should also visit your local library as they have books on property reviews that can be very informative.

Guide For Filing At Orange County Property Appraiser

To pay your property tax to the Orlando Property Appraiser, you must file a tax return at www.ocpaweb.ocpafl.org. There are three tax returns to file for the Orange County appraiser:

1.) Homestead Exemption: If you own your home, live there permanently, and have resided in Florida since January 1, you may qualify for the property exemption. The steps to apply for the Homestead Exemption are as follows:

-

- Visit the Orange County Appraiser website (www.ocpaweb.ocpafl.org).

- Click on the “exemptions” menu under the “Click here to make an appointment” button.

- After that, click on the “File by email” option.

- Print the application provided in the hyperlink as “Application Form and Instructions.”

- Review the requirements listed in this section and obtain the appropriate documents, such as a deed certificate, driver’s license, etc.

- A Florida driver’s license or Florida ID must serve as proof of residency for each applicant, either a Florida driver’s license or Florida ID if you are not a driver.

1. Florida Driver’s License (required)

2. Identity Card (mandatory if you are not a driver)

3.Vehicle Registration

4.Voting record

5. Declaration of address (if you do not have a second identification document, you must register with the tax office first)

- Once completed, submit your application by March 1, 2023. Send your application and supporting documents to [email protected]. Please include “Confidential Information” in the subject line of the email.

- If you need it by mail, send it to:

- Orange County Property Appraiser

- Attention: Exemptions

- 200 S. Orange Avenue, Suite 1700

- Orlando FL 32801

2.) Tangible Personal Property: Tangible personal property is anything other than real estate used in a business or rental property. The steps to file an actual personal property tax return are as follows:

-

- Visit the Orlando Property Appraiser website.

- Click on the “TPP tax return” menu.

- Click on the “Save form as PDF” option.

- Clicking on the option to “Save the form in PDF” will deliver the four pages in pdf format. Return the form to: 1. By Email: [email protected] 2.By Postal Address: 200 S. Orange Avenue, Suite 1700, Orlando, FL 32801

3.) Income Survey:

- Visit the Orlando Property Appraiser website (ocpaweb.ocpafl.org).

- The next step is to click on “Income Survey.”

- By clicking on the “Income Survey” option, you will receive the following instructions that you must follow.

- After reading the instructions, enter the DOR usage code from Orlando property’s income and expense request letter and click on the search option.

How To Search For A Property By Using Orange County Property Appraiser Search?

Searching for residential properties in Orange County, Florida, has become easier for residents who own or want to rent or sell real estate with the help of Orange County Property Appraiser Search. Tips for finding your property through Orange County Property Appraiser Search are listed below:

- Visit ocpaweb.ocpafl.org.

- When opening the Orange County Property Appraiser Search website, click on the “Property Search” option.

- Five options are available on the Orange County Property Appraiser Search website: (a) Quick Search, (b) TPP/Advanced Search © Results, (d) Property Maps (e) TPP Maps.

- The first option is (a) Quick Search: In Quick Search, there are two options at the bottom: Single or Multiple.

- Under Simple Quick Search, enter the requested credentials and click Next. A simple, quick search will give you the Orange County Property Appraiser Map at the address listed in your credentials.

- Enter the address for various quick lookups. You need to enter your house number, address, street name*, and the street type and click “Search by address.” Another suggestion for several quick searches is to enter your credentials in the button “Search by address” and click “Near By.”

- The next option is (b) TPP/Advanced Search: This type of Orange County Property appraiser search requires you to click “Search (select an option)” and select options from this drop-down menu. Then enter search data or click on Search.

- Orange County Property Appraiser Search Results, Property Maps, and TPP Maps are available after searching your property using the Orange County Property Appraisers Map Quick or Advanced Search.

Benefits Of Orange County Property Appraiser Florida

An Orange County property appraiser Florida plays a significant role in the area’s real estate market. The benefits of the Orange County Property Appraiser Florida are listed below:

Fair And Accurate Assessment- This property appraiser provide a fair and accurate assessment of a home’s value. Orange County Property appraisers are increasingly using the computerized bulk appraisal. It’s a better and more comprehensive way of determining a home’s fair value than any other known method.

Provides Financial Advice- The second thing a good Orange County property appraiser Florida can do for homeowners is financial advice. By hiring a qualified appraiser who is also a CPA, these individuals can help homeowners understand which parts of their home do not count in the tax calculation.

Tools Available At Orlando Property Appraiser

Two tools are available in Orlando Property Appraiser:

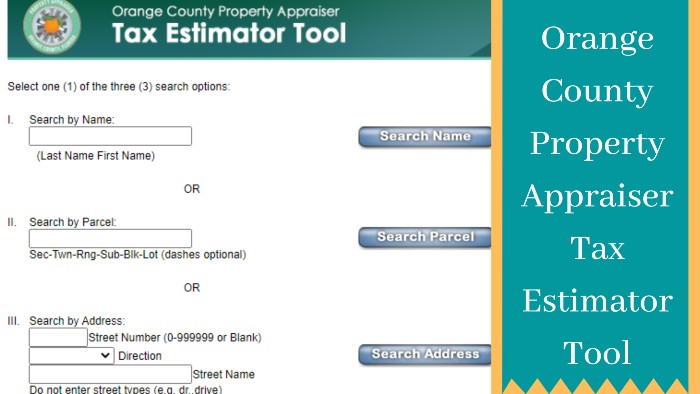

1.) Tax Estimator: The Tax Estimator is the gateway to property tax estimation for property valuation in Orange County. Let’s you know the future tax value of the property. Follow these steps to access the tax estimation tool on the Orange County Property Appraiser website:

- Visit the website (ocpaweb.ocpafl.org).

- On the website, click the Knowledge Base menu.

- You will find the “Tools” option next to the “Property Information” in the knowledge base menu.

- Two tools are available for Orange County Real Estate Appraiser in the Tools option: (a) Tax Estimator and (b) Sales Analysis Tool.

- In the Tools option, click Tax Estimator.

- Once you click on “Tax Estimator,” you have three options here:

(i) Search by name (last name, first name)

(ii)Search By Parcel (Sec-Twn-Rng-Sub-Blk-Lot (optional dashes))

(iii) Search by address (house number, address, street name)

- You can choose one of the three tax estimation options above. However, be sure not to enter the road type when selecting the third option.)

2.) Sales Analysis Tool

- Another tool available to the Orange County real estate appraiser is the Sales Analysis Tool. With this tool, you can analyze the home sales in Orange County. It shows trends in analyzing real estate values, tax amount, number, and deals from previous and current years.

Customer Service Facility For Orange County CA Property Appraiser

Customer service facilities are available at the Orange County Property Appraiser for inquiries related to filing tax returns, logging in, paying property taxes, etc. You can contact the Orange County CA Property Appraiser Office by phone, email, or writing.

Florida law considers email addresses public information. Otherwise, contact Orange County CA Property Appraiser office by phone or mail. To communicate in writing with the Orlando Property Appraiser office, you can formulate your questions and send them to the address of this office:

Mailing Address

200 S. Orange Avenue

Suite 1700, Orlando, FL 32801

Public Records Requests: For Public Records Requests only, email at [email protected]

Phone Numbers:

Constituent Services – (407) 836-5044

Residential Assessment – 407-836-5205

| Official Site | Orange County Property Appraiser |

|---|---|

| Search Type | Property Search |

| Languages | Multiple |

| Country | United States Of America |

| Managed By | OCPA |

Mobile App For Orange County Tax Appraiser

Do you take your smartphones with you? Because today, all of our Orange County, Florida residents use smartphones to access online social media accounts, call, chat and email friends, colleagues, and family. Likewise, Orange County Tax Appraiser has its mobile app called Orange County Property Appraiser, Amy Mercado.

This app is available to all orange county tax appraisers and their customers on the Play Store. This app is free for all smartphone users in Orange County. Just download and install it on your smartphone.

Features Of Orange County Property Appraiser, Amy Mercado Mobile App:

- Search for a property by registering your account on the Orange County Property Appraiser, Amy Mercado App.

- Receive daily updates from the Orange County Property Appraiser.

About Orange County Appraiser

The Orange County Real Estate Appraiser is responsible for the appropriate identification, location, and valuation of all real and personal properties in the county for tax purposes. Assess the value of all available properties by tracking ownership changes, managing plot boundary maps, maintaining building descriptions, accepting and approving exemption requests, and analyzing the evolution of sales prices, construction costs, and rents.

As of January 1, 1995, Orange County Real Estate Appraiser amended the Florida Constitution to limit the annual increase in the appraised value of exempt residential property to 3% or the inflation rate, whichever is lower. This restriction prohibits any alteration, addition, or improvement to the property. Orange County Property Appraiser’s sole duty is to determine fair and reasonable value within the scope of the tax proceeding.

Orange County Property Appraiser is known for its cutting-edge technology approach to the assessment process. Experienced appraisers regularly use Computer Aided Mass Appraisal (C.A.M.A.) to ensure fair prices for all homeowners. In its sole discretion, it reserves the right to remove or reject any electronically uploaded image for any reason or no reason. The website remains under the control of the company.

Suppose you have Orange County appraisers who occupy or take up permanent residence on or after January 1. In that case, you can reduce the appraised value of your property by up to $50,000. Tax savings can reach approximately $750 per year. Submit your application by March 1 of the year of your application. Failure to apply will be considered a waiver of the exemption. You can complete the forms by email, online, or in person.

Frequently Asked Questions

In Orange County, Florida, many property tax filers must have questions about the Orange County Appraiser. Here are some questions and answers to improve your understanding of the Orange County Property Appraiser:

How To Book An Appointment In Orange County Property Appraiser Office?

The steps for scheduling an appointment at the Orange County Appraiser’s office are listed below:

- Visit the Orlando Property Appraiser website.

- Click the “Click here to schedule an appointment” button on the website’s home page.

- Then select “Service” from these options: “Household Waiver,” “Commercial Appraiser Meeting,” “Personal Physical Property,” “Mapping Services,” and “Housing Appraiser Meeting.”

- Choose your availability in the “Select time” option.

- Please enter your information, such as name, email address, address, and phone number, and then read the legal notice.

- Finally, click Book.

Is There A Limit To How Much Portability I Can Transfer?

The maximum amount allowed by law is $500,000.

Can I Benefit From A Tax Exemption?

In addition to expertise, the real estate specialist receives requests and manages IPTU exemptions.

There are different types of exemptions. The type of exemption most homeowners get is the Homestead Exemption. You can claim property exemption if you own property as your primary residence on or after January 1. This step will reduce your home’s appraised value by up to $50,000, saving you $700.

Other exemptions include seniors with limited income, widowers, permanently disabled, disabled veterans, religious, community service, and education exemptions.

Conclusion

Finding an Orange County property appraiser to help with this region’s real estate market actions can make finding the right home for any buyer more straightforward. Indeed, without a proper assessment of the real estate market, individuals, companies, governments, and others would not be able to adequately assess investment opportunities, rendering them virtually useless as a decision aid.

Selling a home gives you several options. However, it is worth working with an experienced Orange County real estate appraiser to get a fair appraisal and accurate value for your home. It is important to note that you must hire a qualified person, whichever option you choose. Buying a house shouldn’t cost more than it has to.